Though many conclude that recession Is coming, this poet’s impression Cannot overcome A key rule of thumb More jobs mean recession repression As well, on the fourth of July The naysayers all went awry The BBB’s law As Trump oversaw Parades and a massive fly-by

I will be brief this morning. First, Thursday’s NFP report was much stronger than expected, with 147K new jobs and the Unemployment Rate falling to 4.1%. This is clearly not pointing in a recessionary direction, although as would be expected by all those who have made that call, there was much analysis about the underlying makeup of the jobs report, with more government hires and less private sector ones. And I agree, I would much rather see private sector hiring, but I don’t recall as much angst in the previous administration when they hired into the government extremely rapidly. It is difficult for me to look at the below chart of government hiring over the past five years and conclude that this administration is being anywhere nearly as profligate.

Source: tradingeconomics.com

Second, despite all the naysaying by the punditry, President Trump got his Big, Beautiful Bill through Congress and he was able to sign it on his schedule, July 4th. Whether you love Trump or hate him, you must admit that he is a remarkable political force, greater than any other president I can remember, although Mr Reagan was certainly able to accomplish many things with a very different style. And perhaps, that is the issue, Trump’s style is unique in our lifetimes as a president, although I understand that throughout our history, there have been some presidents with a similarly brash manner, I guess Andrew Jackson is the best known. And it is that style, I would say that leads to the Trump Derangement Syndrome, although his attack on the Washington elite is also a key driver there.

Thus far, the articles I have read about the legislation all focus on how many people are going to die because Medicaid is requiring able-bodied adults to work, volunteer or go to school 20 hours/week in order to remain eligible. It would be helpful if these ‘news’ sources could keep a running tally so we can all see the results. Given the law simply sets priorities, and not actual appropriations yet, my take is all this death and destruction may take a few months yet to materialize.

But after those two stories, there is a growing focus on the upcoming Tariff deadline this Wednesday, with a mix of views. There is both a growing concern that the original level of tariffs is going to be put back in place, and that will disrupt global commerce, and there is a story gaining traction that the deadline will be delayed again. The administration hinted there would be some notable deal signings this week, so we shall see.

As that’s all there is, let’s look at markets overnight. Thursday’s US rally in the wake of the NFP data is ancient history. Overnight in Asia, the major markets (Japan -0.6%, Hang Seng -0.1%, CSI 300 -0.4%) were under pressure but the rest of the region was mixed with some gainers (Korea, Indonesia, Singapore) and some laggards (Taiwan, Malaysia, Australia) although none of the movement was very large, 0.5% or less in either direction. In Europe this morning, the DAX (+0.65%) is far and away the leader after a stronger than expected IP reading of +1.2%. However, the rest of the continent and the UK are all tantamount to unchanged in the session. US futures at this hour (7:00) are pointing slightly lower, about -0.025%.

In the bond market, Treasury yields which rallied 5bps on Thursday after the data are higher by one more basis point this morning. European sovereign yields are all higher this morning as well, between 2bps and 3bps, as concerns over the timing of tariffs has investors cautious. The rumors are solid progress has been made in these negotiations.

In the commodity space, oil (+0.7%) is higher this morning which is a bit of a surprise given that OPEC+ raised their production quotas by a more than expected 548K barrels/day at their meeting this weekend. At this point, they are well on their way to eliminating those production cuts completely. I guess demand must be real despite the recession calls. Metals markets, though, are all lower this morning (Au -1.0%, Ag -2.0%, Cu -0.6%) as hopes for trade deals has reduced some haven demand. Of course, copper’s decline doesn’t jibe with oil’s rally on a demand note, but the movements have not been that large, so it is probably just random fluctuations.

Finally, the dollar is stronger this morning, which is also weighing on the metals markets. ZAR (-1.1%) is the biggest loser overnight although NZD (-0.9%) and AUD (-0.7%) are doing their best to catch up. But the euro (-0.35%) and pound (-0.3%) are both under pressure as is the yen (-0.7%) and CAD (-0.5%) and MXN (-0.5%). In other words, the dollar’s strength is quite broad-based. On this note, I couldn’t help but chuckle at this article in Bloomberg, Misfiring Models Leave Wall Street Currency Traders Flying Blind, which describes how all the old models no longer work in the current world. This is a theme I have harped on for a while, mostly with the Fed, but also with the punditry in general. The world today is a different place, and I might ascribe the biggest difference to the fact that for 20+ years, inflation had fallen to 2% or lower in most of the western world and markets behaved accordingly. But now, inflation is higher, and those relationships no longer hold.

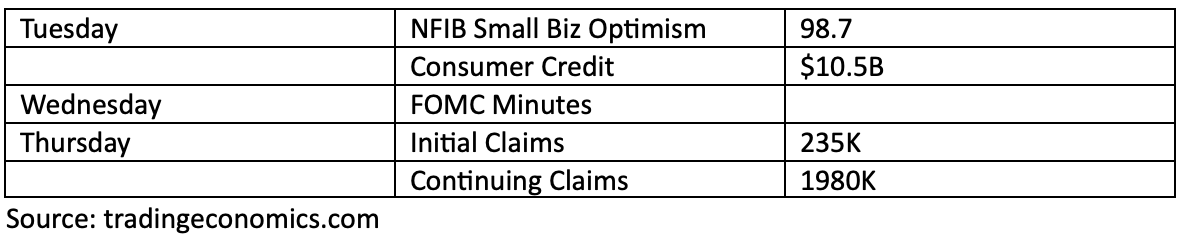

On the data front, this may be the least active week I have ever seen.

There are only 3 Fed speakers as well so pretty much, Washington is on vacation this week. It is very hard to get excited about much right now. We will all need to see the outcomes of the trade negotiations and which countries will see tariffs applied or not. I have no forecasts for any of that. In the meantime, I think the fact that implied volatilities are relatively low across most asset classes offers the opportunity for hedgers to protect themselves at reasonable prices.

Good luck

Adf