The data remains quite vexatious As some shows that growth is bodacious But other releases Are closer to feces Implying the first stuff’s fallacious For instance, the GDP print At two point eight offered no hint Recession is nearing Yet stocks aren’t cheering For bears, in their eyes, there’s a glint But Durable Goods was abysmal At minus six plus, cataclysmal And more survey data Implied that pro rata The story ‘bout growth’s truly dismal

In the past week, we have seen a decent amount of data, and the upshot is that there is still no clarity on the US economic condition. Many analysts accept the data at face value, and with today’s GDP print as the latest installment, dismiss the idea of a recession coming soon. Others look at the headline, and then the underlying pieces and detect that ‘something is rotten in Denmark the US’.

A quick review of the recent data shows the housing market is weakening further, with both New and Existing Home Sales declining on a monthly and annual basis. As well, the Survey data showed the Richmond and Kansas City Fed’s Manufacturing Indices falling deeper into negative territory as well as a weak Flash PMI Manufacturing print. Durable Goods headline fell -6.6%, which while it is a volatile series (depending largely on airplane deliveries by Boeing), was still a terrible outcome. Absent transports, though, it rose 0.5%, which seems more in line with the first look at Q2 GDP, showing a 2.8% annualized growth rate. (One thing to watch in that GDP report is the PCE index that is implied and showed a surprising rise. Keep this in mind for tomorrow’s PCE report.). Alas, final Sales in the GDP report only rose 2.0%, a potential harbinger of future weakness.

If we go back and look at the CPI data, which was soft, or the NFP data, which was strong, there continue to be underlying pieces of almost every report which indicate weakness compared to headline strength or vice versa. So, which is it, recession or no?

Unfortunately, we will not know until the next recession has likely finished given the NBER’s methodology of declaring a recession. (It is important to understand in the US, the rule of thumb, two consecutive quarters of negative real GDP growth is not the definition.) Regardless, we haven’t even had one quarter of negative growth. This poet’s view is that the economy is clearly slowing down with respect to activity but does not seem like it has yet tipped into recession. Perhaps things will be clearer in Q3, but for now, the arguments are going to continue.

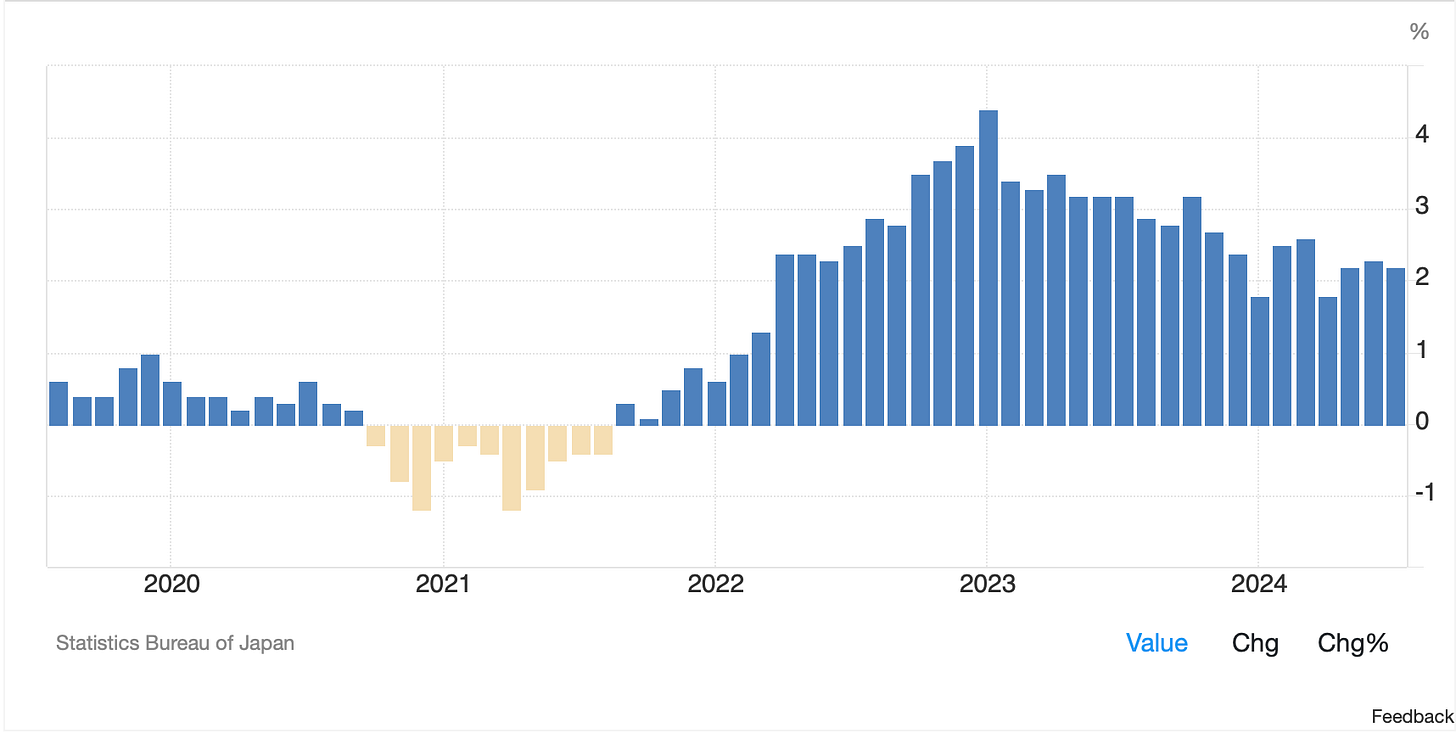

Tokyo prices Keep on decelerating Why will they tighten?

Tokyo CPI data was released overnight and once again, it was a touch softer than expected with both headline and core printing at 2.2%. In fact, the ex-food & energy index rose only 1.1% Y/Y! The Tokyo data is typically a harbinger of the national number and when looking at the data, it is easy to understand why Ueda-san is reluctant to tighten further. As per the chart below, the trend here remains toward lower inflation without any further policy adjustments.

Source: tradingeconomics.com

So, why would they move next week? This is especially so given the yen has rebounded nearly 6% over the past several weeks, relieving pressure on the biggest current concern. I know it is fashionable to think that the BOJ is going to tighten policy while the Fed cuts, but it is not difficult to make the case that the US economy is continuing to tick along and so higher for longer remains appropriate, while in Japan, price pressures are easing without any further policy tightening. There is increasing analyst discussion the BOJ is going to move, but I remain suspect, at least at this point. Rather, I expect that there is probably more short-covering to come in the JPY and that is going to further relieve pressure on the BOJ to act.

This morning, we get PCE The data most pundits agree Will license the Fed To cut rates ahead At least that’s the stock market’s plea

The final big story today is the release of the PCE data. As we all know by now, this is the inflation metric the Fed uses in their models. Current median expectations are as follows: Headline (+0.1% M/M, 2.5% Y/Y) and Core (+0.1% M/M, 2.5% Y/Y). In both cases, that would represent a tick lower in the annual number compared to last month, and based on the current narrative, would add to the Fed’s confidence that inflation is coming under control. And maybe that will be the case. After all, the past two inflation reports have come in below the median expectations.

However, there is another PCE report that is published alongside the GDP data. Essentially, it is the number that determines how much of nominal GDP is actual growth and how much is price growth. As part of yesterday’s GDP release, the core PCE index rose at a 2.9% rate, lower than Q1 but above expectations. I’m merely pointing out that as seen above, there is a lot of conflicting data out there. It would be premature to assume that inflation is under complete control in my view, although that is the growing market belief.

Ok, let’s look at what happened overnight. Equity markets are trying to figure out what everything means right now. Yesterday’s US performance was mixed, with Tech stocks still under pressure although the DJIA managed to gain on the day. Overnight, Japanese stocks (-0.5%) continued their recent decline, following the NASDAQ lower, but both Hong Kong and China managed small gains on the session. As to Europe, most major indices are in the green led by the CAC (+0.85%) despite the terrorist attacks on the high-speed rail network as the Olympics begin there. But after several down days, investors feel like the correction has run its course and are coming back. This is evidenced by US futures which are higher by upwards of 1% at this hour (6:30).

After yesterday’s more aggressive risk-off session, this morning bond yields are little changed to slightly higher around the world. Treasuries are unchanged and European sovereigns have seen yields rise by either one or two basis points. JGB yields, too, are higher by 1bp, as it appears investors have been exhausted by this week’s volatility. Of course, a surprising number this morning will almost certainly get things moving again.

In the commodity markets, oil, which managed to rebound at the end of the day yesterday, is lower by -0.4% this morning. Given the volatility across all markets right now, it is difficult to come up with a coherent story about the situation here in the short run. Gold (+0.4%) which got decimated yesterday, has run into technical support and is rebounding, but the same is not true for silver or copper, both of which remains near their recent lows. I will say this about copper; as it remains one of the most important industrial metals, its weakness does not seem to bode well for economic growth going forward, and yet as we saw yesterday, US GDP is running above trend. This is simply more evidence that confusion reigns in market views.

Finally, the dollar is generally lower this morning. While the yen (-0.55%) is giving back some of its recent gains, almost all of the other major currencies in both the G10 and EMG blocs are a touch stronger. MXN (+0.7%) is the leader followed by ZAR (+0.5%) with most others gaining much smaller amounts. The thing is, aside from the US data, there has been precious little other data of note that would drive things. One might make the argument that the rebound in gold is helping the rand, but that seems tenuous. Right now, with risk being re-embraced, my take is the dollar is simply softening a bit.

In addition to the PCE data we also see Personal Income (exp 0.4%) and Personal Spending (0.3%) and then at 10:00 we get the Michigan Sentiment Index (66.0). But all eyes will be on PCE. I look at the GDP data and think we could see something a bit hotter than currently forecast and desperately hoped for. If that is the case, I suspect that stocks may falter and bonds as well although the dollar should regain ground.

Good luck and good weekend

Adf

Great piece Andy. The data tea leaves are remarkably unhelpful at the moment!

The data remains quite vexatious

As some shows that growth is bodacious

But other releases

Are closer to feces

Implying the first stuff’s fallacious

Love this. LOVE it. Suitable for framing...