It seems that when bad news is good Some things are not well understood So, risk assets rally And traders who dally Miss out making gains that they could But that was the story last week And looking ahead we shall seek The narrative changes That altered the ranges Of assets that used to look bleak

It has been a pretty quiet session overall and, in truth, the upcoming week does not look all that interesting from a market perspective. While we do get the RBA policy announcement tonight (exp 25bp hike to 4.35%), and a great deal of Fedspeak including Powell on both Wednesday and Thursday, from a data perspective, there is nothing of note on the horizon.

As such, I feel like it is a good time to review the recent data and policy decisions that have led to the market gyrations through which we have been living. If you recall, heading into last week, the narrative had been focused on the continued bear steepening of the yield curve as bond yields were rising on the anticipation of a significant increase in supply. This movement was weighing on equity markets, which had just finished an awful week. While risk was under pressure, we saw dollar strength although oil markets were in the midst of pricing out an expansion of the Israeli-Hamas conflict into a wider Middle East war impacting oil production or shipments. Generally, the mood was bearish and there were many questions as to the timing of the much-anticipated recession.

And then last week turned almost everything on its head. Starting with the BOJ, which adjusted its YCC policy again, although in a more flexible manner, removing the hard cap on yields at 1.00% and instead calling that a goal, rather than a cap. Not surprisingly, the first move was for JGB yields to rise sharply, although they have not yet touched 1.00%, and, also, not surprisingly, the BOJ was in the market with an unscheduled round of JGB purchases the next day. In the end, I think it is fair to say that while the BOJ is still running the easiest monetary policy in the world, it is somewhat tighter at the margin.

Meanwhile, the Fed’s reaction function seems to have been adjusted by the bond market’s bear steepening price action. Several weeks prior to the FOMC meeting last week, Dallas Fed President Lorrie Logan was the first to mention that higher long-dated yields were tightening financial conditions and doing some of the Fed’s work for them. Subsequently, we heard several other Fed speakers reiterate that idea, with some going as far as saying they thought it was worth between 50bps and 75bps of tightening. At the FOMC press conference last Wednesday, Chairman Powell jumped on that bandwagon, and though he attempted to sound somewhat hawkish, claiming that they remained data dependent and if inflation remained hot, they would hike again, nobody really believes him anymore. According to the Fed funds futures market, the current probability of a rate hike in December is down to 9.8%. That was nearly 30% just before the FOMC meeting and has been sliding ever since.

It seems fair to ask, what has changed all these attitudes? I would argue that the Treasury’s Quarterly Refunding Announcement (QRA) which is generally completely under the radar, was the big news that altered the narrative. Then, adding to the new momentum, we got clearly weaker than expected employment data, implying that the Fed’s data dependence was going to be heading toward rate cuts sooner rather than rate hikes at all.

Briefly, the QRA is, as its name suggests, the document the Treasury issues each quarter to inform the market of how much new Treasury debt will be issued for the next two quarters, as well as the anticipated mix of issuance between T-bills and longer dated coupons. In the most recent version, Secretary Yellen indicated that the Q4 issuance would be lower than had previously been expected, and she also indicated that a greater proportion would be in T-bills than expected. The combination of these two features cut the legs out from under the oversupply issue, at least temporarily (there is still an enormous amount of debt coming) and combined with what had clearly been developing short bond positions by the hedge fund and CTA communities, saw a major reversal in bond prices with yields declining > 40bps last week.

It should be no surprise that stock markets took that news and ran with it. Part of the previous narrative was the continuous rise in yields was devaluing future earnings in the equity market. As well, earnings season saw decent numbers, but lots of lower guidance by company management downgrading future assessments. While Q3 GDP was a hot, hot, hot 4.9%, the Atlanta Fed’s first look at Q4 GDP is for a much more sedate 1.2%. If that is what Q4 is going to look like, it is hard to get excited about earnings growth. So, prior to last week, equity markets had declined ~10% from their recent highs, a very normal correction, and the big question was, is this the beginning of the next leg lower in a longer-term bear market, or was this just a correction?

Taken together, and adding in a much weaker than forecast NFP report on Friday, where the headline number fell to 150K, and there were revisions lower for the previous two months by an additional 40K while the Unemployment Rate ticked up to 3.9%, its highest print since January 2022 and 0.5% higher than the cycle lows, the new market narrative seems to be as follows: the Fed is done hiking and the only question is when they will start to cut rates. The high in longer-term yields has been seen as well since the data is starting to roll over. This will lead to further downward pressure on inflation and the soft landing will be completed. The upshot of this narrative is, of course, BUY STONKS!!!

And that was the outcome from Wednesday on last week, a major reversal in equity market weakness, a huge rally in bond prices and decline in yields and a general warm and fuzzy feeling. And who knows, maybe they will be correct. But…

1. The combination of higher stocks and lower bond yields has eased financial conditions considerably in just the past week. This implies the Fed may be forced to act to continue their program lest inflation reasserts itself.

2. The idea that slowing growth is a positive for equity prices seems a bit skewed as slowing growth typically leads to weaker profits.

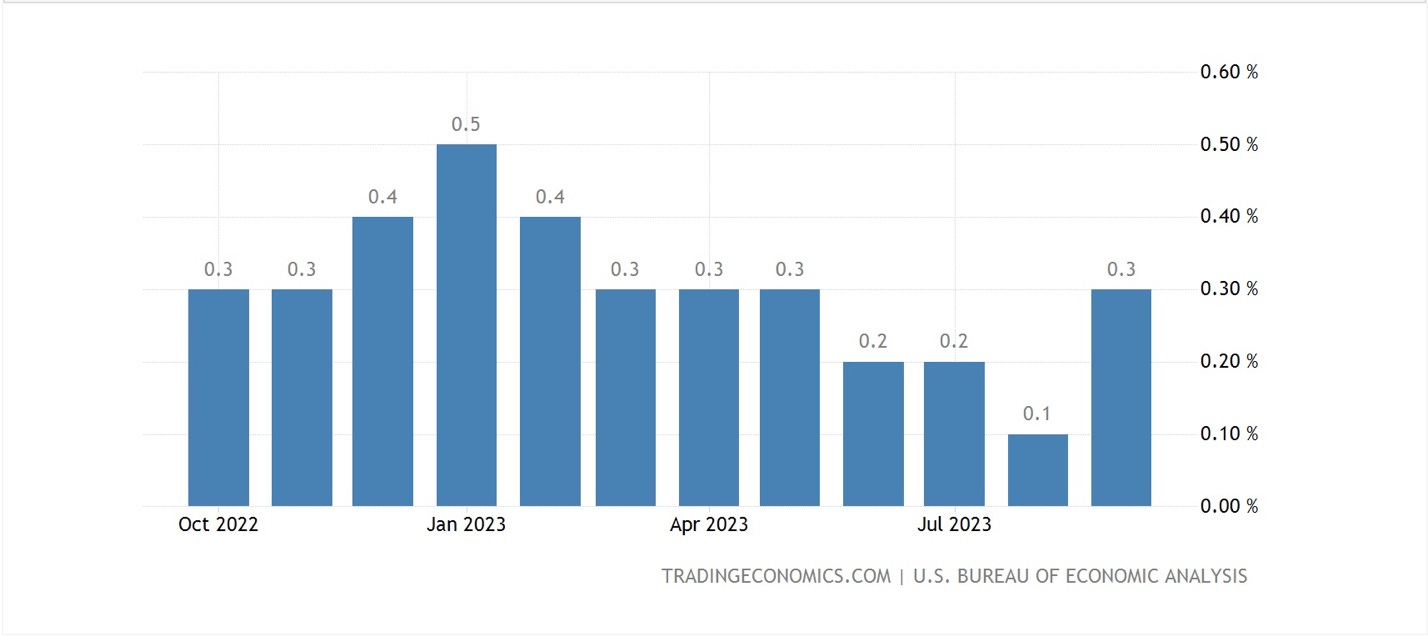

3. Inflation is not dead yet, and the most recent Core PCE reading did not indicate that it is slowing that rapidly. As can be seen from the chart below, 0.3% M/M PCE equates to 3.6% annual, well above the Fed’s target.

While I believe that the market is going to run with this narrative for a while, and we could easily see stocks continue to rebound and yields grind a touch lower, I fear that reality will set in soon enough and these moves will prove ephemeral.

Tying this up with a bow on the dollar leaves me with the following view; as long as this current narrative holds, the dollar will remain under pressure. I suspect this can last through the end of the year, although much beyond that I am far less certain. I would contend there are two ways things can evolve from here:

1. This relaxation in financial conditions forces the Fed to reassert themselves and they start hiking rates again. In this case, the dollar will once again rise as no other central banks will have the ability to keep up with a newly hawkish Fed, or

2. The much-anticipated recession finally shows up, perhaps in Q1 2024, and the Fed, after a little hesitation starts to ease policy. However, by that time, I suspect that the rest of the world will also be in recession and central banks elsewhere will be cutting rates even more quickly. While the dollar is likely to slide initially, I don’t think it will decline very far as in that situation, it seems likely that the US will remain the proverbial ‘cleanest shirt in the dirty laundry.’

As for today, it is hard to get excited about anything really, at least with respect to the FX market.

There will be no poetry tomorrow, but I will return on Wednesday.

Good luck

Adf

Nice write up - TY

great job man, thanks.